The US recreational boating market enters 2026 in a relatively stable position, supported by steady boating activity and continued demand across more accessible segments, according to data released this week by the National Marine Manufacturers Association (NMMA).

The trade body represents approximately 85 per cent of the US market for recreational boat, marine engine and accessory manufacturers.

NMMA estimates that — in the US — total new powerboat retail unit sales, including traditional powerboats and personal watercraft, fell by an estimated 8 per cent to 10 per cent in 2025 to between 215,000 and 225,000 units. The association attributes this decline to economic conditions that affected discretionary spending during the year. For 2026, new powerboat unit sales are expected to be broadly in line with, or slightly above, 2025 levels amid continued mixed economic conditions.

During 2025, sales volumes were concentrated in entry-level categories such as personal watercraft, aluminium fishing boats and smaller boats that can be trailered to local waterways. These segments accounted for more than 90 per cent of retail unit activity. Freshwater fishing boats were a volume leader during the year, with unit sales holding steady compared with 2023 at approximately 53,000 units.

Pre-owned boat sales continue to represent a substantial share of market activity. According to the most recent data available, pre-owned boats accounted for around 80 per cent of total annual unit sales. In 2024, pre-owned unit sales reached nearly 860,000, a decrease of 6.5 per cent compared with 2023.

Market activity is also supported by participation from an estimated 11m registered boats in use across the US, alongside increased use of shared-access models such as boat share clubs, peer-to-peer rentals and charter options. This participation underpins spending on aftermarket accessories and boating outings, which together reached $24.5bn in 2024. That level was broadly consistent with the period following the industry’s covid sales surge. Participation-related spending is expected to remain at similar levels through 2026.

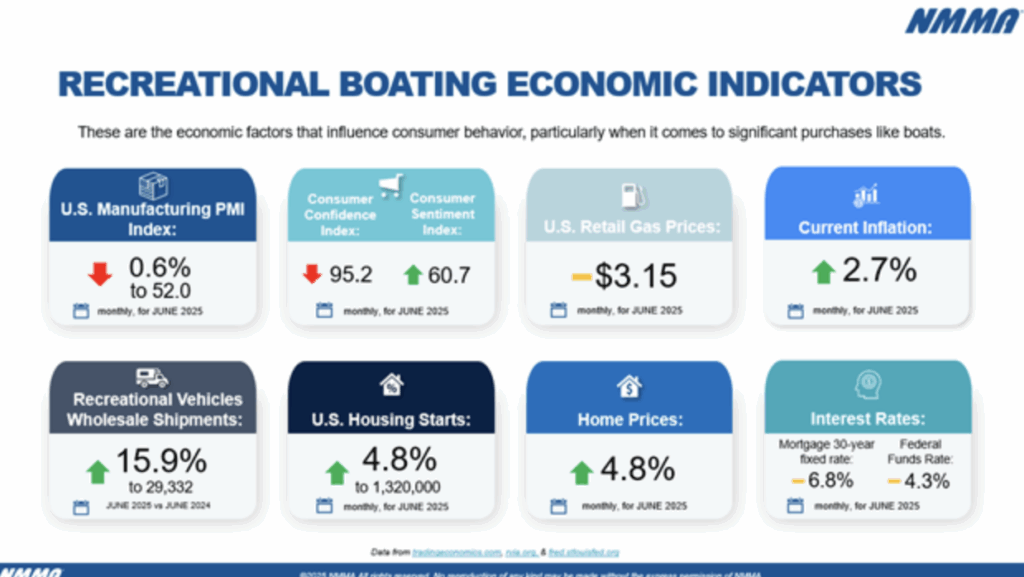

Recent sentiment data from NMMA’s third-quarter 2025 survey of member executives indicates a modest improvement in short-term economic outlook. Forty per cent of respondents reported a positive 12-month outlook, compared with 32 per cent in the second quarter. The survey reflects expectations of potential support from larger tax refunds and easing interest rates, alongside ongoing pressures linked to labour market conditions and trade barriers.

“The mixed and uncertain economic environment that persisted throughout 2025 brought material impacts to the recreational boating market and a wait-and-see mindset for some boating consumers,” says Frank Hugelmeyer, NMMA president and chief executive officer.

“While last year’s economic uncertainty and softness is expected to persist into 2026, manufacturers have adjusted and there is cautious optimism for positive momentum in 2026 as key consumer segments engage in boating through a range of pathways, from entry-level and pre-owned boats to boat clubs and shared access options that align with their budgets and lifestyles.”

As the winter boat show season begins, manufacturers and dealers are preparing to present new technology, models and product offerings across a range of price points. Between January and March, dozens of boat shows are scheduled to take place across the US. NMMA estimates that these events account for between 30 per cent and 60 per cent of annual retail sales.

“Boat shows continue to be an essential venue for boaters, manufacturers and dealers,” adds Hugelmeyer. “Across the country, this time of year brings an opportunity for our industry to connect with the broader boating community and prepare for summer, whether it’s a family shopping for their first boat or long-time enthusiasts looking to upgrade, the leading brands and retailers are together in one location to showcase their latest innovations and ways to get on the water.”

The recreational boating sector forms part of the wider outdoor recreation economy, which was valued at $1.2tn and accounted for 2.3 per cent of US gross domestic product, according to the Bureau of Economic Analysis. The industry supports more than 812,000 jobs and over 36,000 businesses, based on NMMA’s economic impact study.

An estimated 85m Americans currently participate in boating each year. Around 61 per cent of boaters report an annual household income of $100,000 or less. The majority of boats in use are under 26ft in length, with 95 per cent capable of being trailered to local waterways.

In 2024, the leading states for sales of new powerboats, engines, trailers and accessories were Florida at $6.1bn, Texas at $2.4bn and Michigan at $1.5bn. Other leading markets included North Carolina at $1.3bn, New York and Minnesota at $1.15bn each, Wisconsin, Georgia and California at $1bn, and Alabama at $970m.

The post NMMA: US boating market ‘stable’ despite 2025 sales slump appeared first on Marine Industry News.

Leave a Reply