Volvo Group reported net sales of SEK 110.7bn ($12.2bn) for the third quarter of 2025, down 5 per cent year on year, with an adjusted operating income of SEK 11.7bn ($1.3bn) and a margin of 10.6 per cent. Adjusted for currency, overall group sales rose 1 per cent.

President and chief executive Martin Lundstedt says: “We are in a period with weaker demand in our key regions and with increased uncertainty in North America. In this situation, we focus on what we can impact. We have adjusted our operations, applied strict cost control, remain firm on commercial conditions and drive our service business.”

Within the marine and industrial operations, Volvo Penta recorded a 7 per cent increase in net sales to SEK 5.03bn ($553m), or 13 per cent when adjusted for currency effects. The division achieved an adjusted operating income of SEK 934m ($103m), corresponding to an 18.6 per cent margin, up from 17.7 per cent in the same period last year.

“Despite lower vehicle volumes, we maintained our earnings resilience and generated an adjusted operating margin of 10.6 per cent,” says Lundstedt.

Order intake rose 28 per cent to 8,190 units, driven by continued growth in marine commercial segments, particularly in defence and passenger transport. The yacht segment showed improvement, while marine leisure activity remained stable at a low level. Deliveries increased 16 per cent to 9,302 units.

Volvo Penta cited higher engine and service volumes as key contributors to the improvement, though an unfavourable product mix and negative currency impact of SEK 185m ($20m) weighed on results.

Impact of US trade tariffs

The firm also notes the disadvantages caused by ongoing US trade tariffs. “Recent tariffs and other trade restrictions imposed or considered to be imposed by the US and other countries have significantly increased uncertainty about trade conditions in markets where the group is present, as well as in relation to global and regional supply chains,” the firm says in a statement.

“The situation is fast-changing and complex to assess, and no predictions can be made on future developments, or whether trade restrictions may impact the group more severely than main competitors. However, the introduction of tariffs, retaliatory tariffs or other trade restrictions on our vehicles, parts, and other products and materials could disrupt existing supply chains, impose additional costs on our business or that of our suppliers, create sudden disadvantages for group operations compared to competitors having different supply chains, and could generally make our products more expensive for customers and/or less competitive. The group will endeavour to adapt to changes in market conditions as they may evolve.”

Lundstedt notes that Volvo Group remains positioned for long-term growth: “With our fuel-efficient and competitive lineup of products and services across the business areas, we are well positioned to capture growth in the next cyclical upturn.”

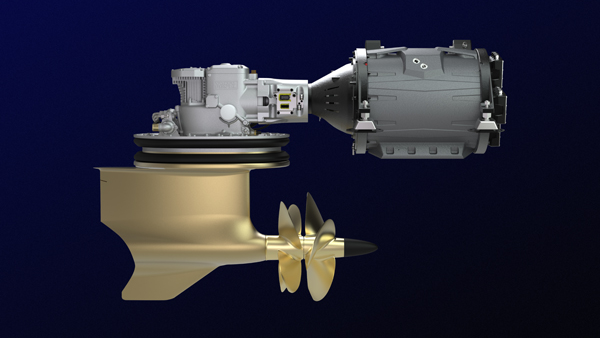

During the quarter, Volvo Penta introduced its next-generation marine autopilot system and marked a milestone for its IPS Professional platform, which was installed for the first time on two superyachts – a Sanlorenzo and an Amer Yacht.

Volvo Penta says its performance reflects sustained demand for marine, commercial and defence applications, alongside investment in onboard control technologies and propulsion systems designed for larger vessels.

The post Volvo Group Q3 2025: Marine operations deliver solid growth appeared first on Marine Industry News.

Leave a Reply